As anticipation for the Super Bowl 2017 heats up, we have released our new NFL Fans Audience Report (clients can download a copy here). Today, we take a look at one of the key themes explored in this new report; specifically, why the NFL has so much at stake in its recent affair with online broadcasting avenues.

In the past year, the NFL have taken some promising steps towards the adoption of online distribution channels. The league’s partnership with various online sites including Twitter, Sina Weibo (the Chinese equivalent to Twitter) and Yahoo are just a few examples of the NFL’s enthusiastic approach here. What’s more, it was announced last month that every single NFL game will be streamed live this season, albeit across a variety of free or subscription-based channels.

This shows a strong initiative to take advantage of the growing appetite for consuming entertainment content online. But if we dig a little deeper, we see that there’s a lot more at play for the NFL than first meets the eye.

What’s Holding Them Back?

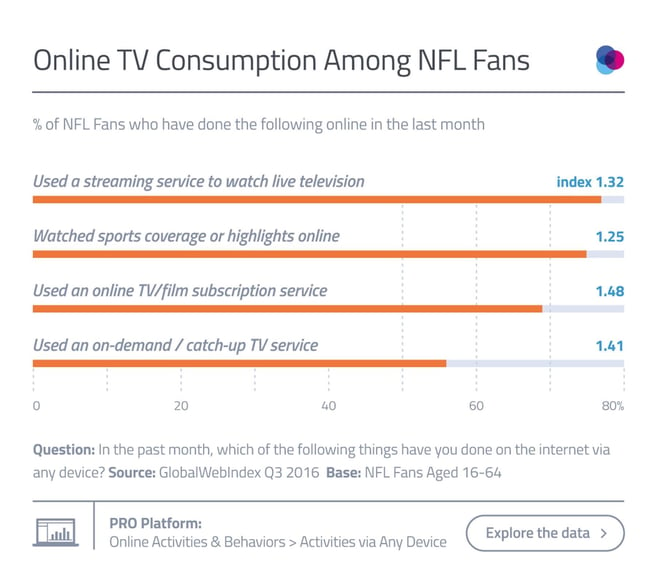

Let’s bring it back to basics – globally, it’s 20% of internet users aged 16-64 who say that they watch the NFL on TV, and 11% who watch via online means, with considerable overlap between these groups. But among NFL Fans specifically, our data shows that 75% are watching sports coverage online via any device, with 77% streaming live television. Meanwhile, around 7 in 10 are using TV/film subscription services with 56% using on-demand TV catch up services. So it may only be minorities who are watching the NFL online to date, but considering how comfortable these digital consumers already are with online TV, this presents an obvious opportunity for the league to tap into.

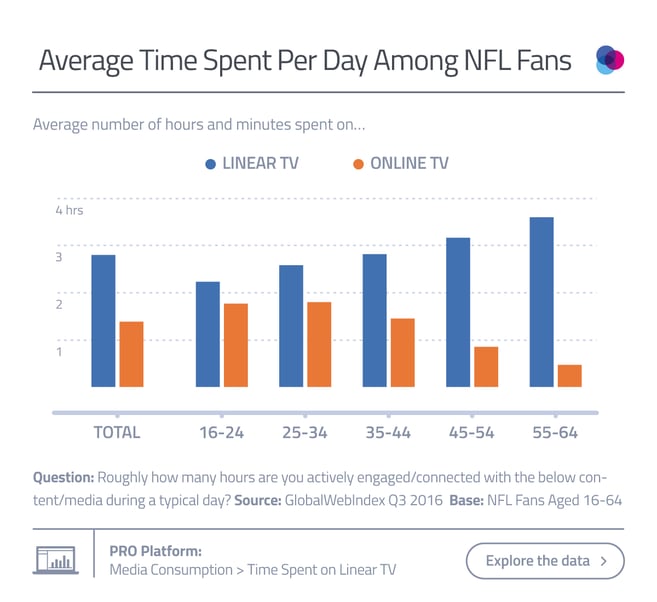

So what’s been holding the NFL back? The simple answer: current distribution rights deals. Compared to online TV, it’s still linear TV that commands the lion’s share of daily media time among this audience. This helps to explain why the likes of ESPN and ACC are confident in paying billions of dollars for NFL TV distribution rights deals which last over 20 years. These drawn-out contracts may seem risky in today’s fast-moving digital landscape, especially with time spent watching online TV on the rise, together with the steady year-on-year decline in daily time spent watching broadcast TV. But as our figures show, linear TV will remain the go-to method of engaging with the NFL for quite some time.

More Than Half Watching Sports on Mobile

That said, online TV (and in particular the explosive growth of live-streaming on mobile) does offer the NFL some potentially lucrative opportunities, especially among younger demographics. ESPN and ACC may be paying billions of dollars to broadcast these games, but Twitter, on the other hand, won the rights to air 10 Thursday night games for the sum of $10 million. It’s not difficult to see why Twitter landed such an extraordinary deal – it’s just one example of the NFL experimenting with new online distribution channels which could create inroads into new and promising markets (i.e. partnering with Sina Weibo in China, a market which boasts some of the highest rates of online TV consumption across our 36 markets), as well as some key desirable demographics. There’s clearly an underlying incentive here – the league itself stated that they did not take the highest bidder on the table running up to the Twitter deal.

Fundamentally, exploring these online distribution channels will help the NFL to prepare for the next round of negotiations in 2021 when the league’s biggest distribution deals are due to expire. Shifting online would give the NFL a chance to evolve alongside the fast-changing media landscape and provide it with more broadcasting options aside from its current long-term deals. What’s particularly noteworthy is that this is set to fall just after our forecasting data predicts that internet users will spend longer each day on their mobiles than on all other devices combined (our data projects this mobile tipping point in 2019). With more than half of NFL Fans watching sports coverage on their mobile each month, there’s undoubtedly a big payoff in wait for the league should it find the right online channels to maximize its reach in the coming decade.