As with the last ‘Explore Our Data’ topic, this question was first added to the ‘Marketing Implications’ section of our study in Q2 2012 and focuses specifically on the online mechanics that most impact the consumer journey.

Question Context: Driving Engagement or Purchase Intent

We talked last time about the concept of ‘brand experience’, or how companies can enable a consumer (customer or not) to interpret a brand and its principles, people and product. In a tangible sense this can be represented by social media, conversational marketing, content, apps, websites, games and much more. This could be summarised in agency parlance as “Owned” and “Earned” media. The key difference to traditional advertising is that the consumer can live and breathe the brand in a deep and interactive sense. They can also contribute, share and advocate regardless of being a customer or not. This is a very real trend, for example Mercedes in China has many millions more online fans than real customers.

Most of our questions explore the best and most motivating ways to create content, enable discovery and build advocacy around this online experience. The question we explore here quantifies how to move an engaged consumer or advocate towards consideration and purchase. While most investment in digital experience or branding is not directly transactional, the end goal is still to grow repeat sales or new business. So this part of the consumer journey is critical to quantify in any future-facing digital strategy.

Using This Data

The key aspect in using this data is the analysing the comparative difference between your audiences’ ranking and the market average. As respondents can pick any statement from the list, very high percentages are not common. These outputs provide guidance for the key mechanics to activate, regardless of the focus of the campaign or digital strategy.

Key Insights

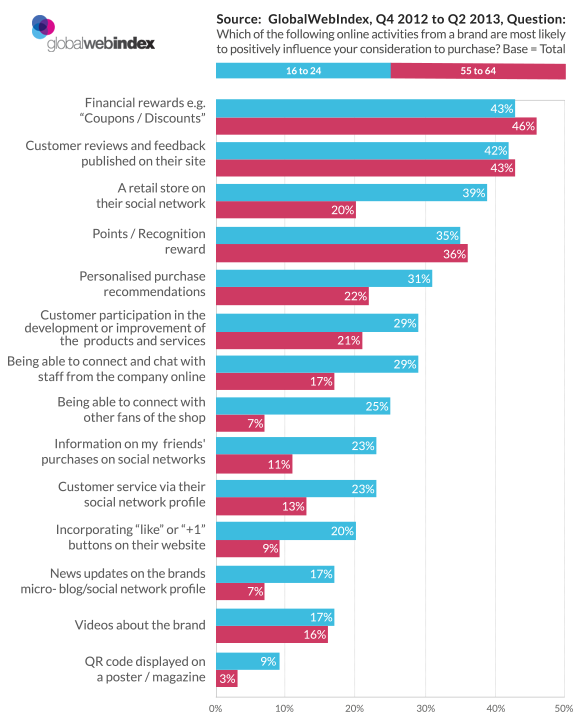

The following chart shows the outputs for 16-24’s versus 55-64’s. This provides some fascinating insights, the first of which is the universal basis to which “Financial rewards” or “Customer reviews” drive purchase consideration (numbers 1 and 2 respectfully). This is true regardless of age or market. “Points and recognition rewards” are also universally stated, with 35% of 16-24’s and 36% of 55-64’s citing them as a positive influence. These three examples show why it is important to be open about incentivising, something that is sometimes thought of as overly tactical.

We can also see the impact of “Retail stores on a social network”, with a massive 39% of 16-24’s citing it as a positive influence on purchase intent. This makes sense, with younger users (particularly in fast-growing internet markets like Brazil and Indonesia) wanting brands to be as accessible as possible. We can also see the importance of social community with factors like “Being able to connect with other fans of the shop” and “Information on my friends’ purchases” being key for younger groups.

Direct access and participation is very important for the younger segments, where 29% stated “Customer participation in the product development process” and “Being able to connect with staff” as a key motivation. This underlines why open brands and organisations are the future. Digital natives expect it.

Finding the Data

PRO Platform Users

Category: Marketing Implications

Sub Category: Brand Activation

Question: Motivation to drive purchase consideration

In the Q2 2013 Questionnaire

Q ID. Q155. “Which of the following online activities from a brand are most likely to positively influence your consideration to purchase?”

All Users can download the data pack from here: Global Motivation to Drive Purchase Consideration